India’s Pradhan Mantri Fasal Bima Yojana (PMFBY) completed nine years this February, establishing itself as a crucial safeguard for farmers against climate change-induced economic losses. But as extreme weather events increasingly threaten agricultural stability, a significant gap exists between the scheme’s promise and farmers’ experience on the ground.

Climate Change intensifies agricultural risks

According to the Center for Science and Environment Report, India faced extreme weather events on 255 days in 2024, following 318 days in 2023 and 314 days in 2022. The agricultural sector has borne the brunt of these environmental challenges, with 3.2 million hectares of farmland affected by adverse weather conditions in 2024 alone.

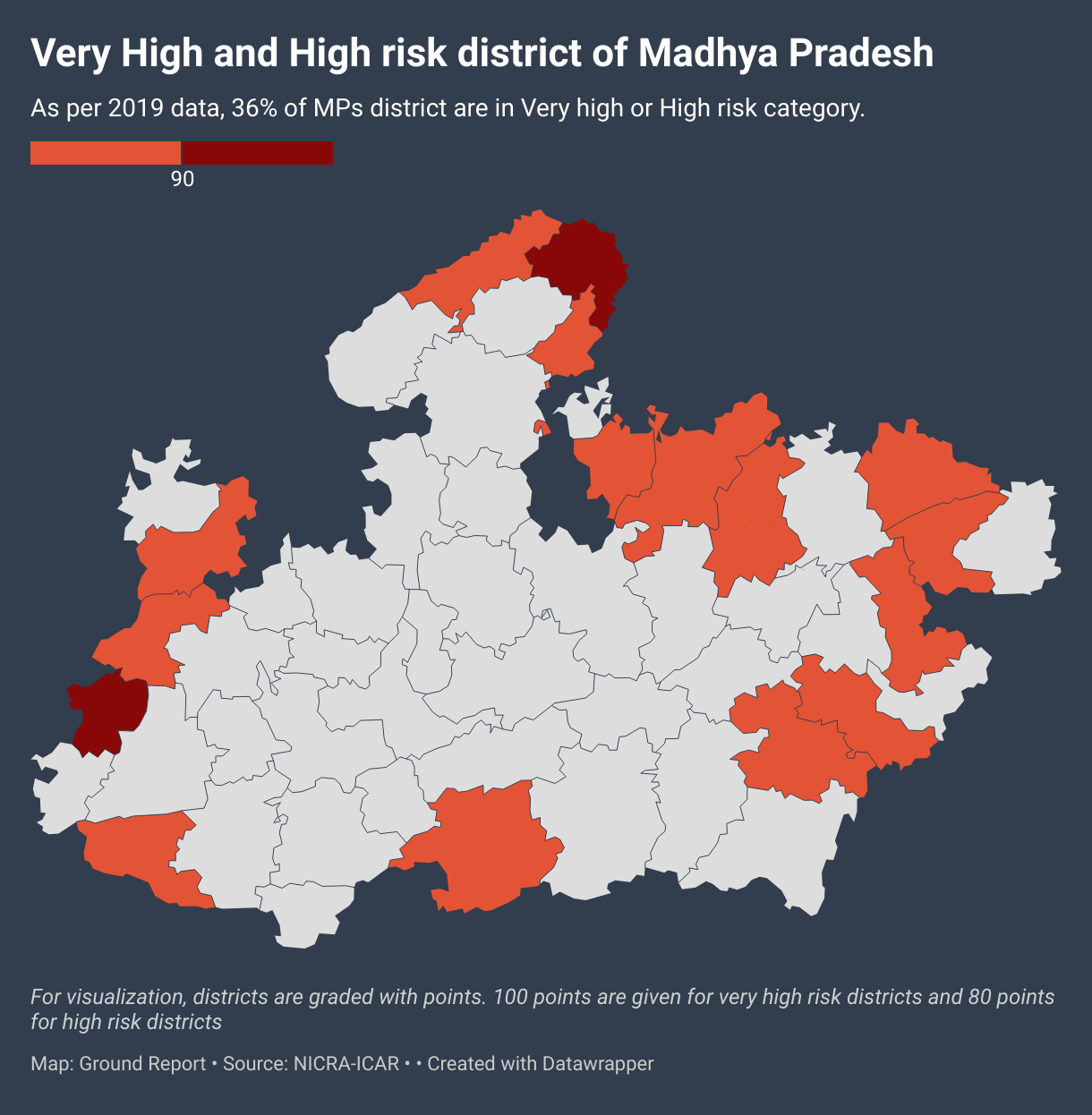

According to the research done by National Innovations in Climate Resilient Agriculture (NICRA) 16 of 45 (2019) districts of Madhya Pradesh are in the very high or high-risk category. This means agriculture in 36% of districts of the state are in the most vulnerable situation. The Center for Science and Environment report reveals that farmers living in the very high and high risk districts are paying more premium but getting less insurance amount in return.

In a country where 70 percent of rural households depend on agriculture, crop insurance should serve as a financial lifeline. However, our ground investigation reveals a troubling reality: while enrolled farmers eventually receive insurance payouts, the painfully slow disbursement process undermines the scheme’s effectiveness.

The critical timing gap in insurance claims

“Crop insurance is just in name,” says 85-year-old Karan Singh from Neelbad village in Sehore district’s Ichchhawar tehsil.

“We have not got the benefit of any insurance till date. Earlier, when crops were damaged, farmers used to get immediate compensation to help cover the expenses of sowing our next crop. But now we have to take loans for sowing.”

Unlike car or health insurance, where claims typically result in prompt financial assistance, crop insurance operates at a frustratingly slow pace. Farmers must often wait months—sometimes years—to receive compensation, defeating the purpose of immediate relief following crop damage.

Dilip Singh, another farmer from Neelbad, expressed his frustration:

“This time we have decided not to complain anywhere. When our soybean was damaged in the rain, we went to the collector and SDM’s office with bundles of crops. We protested, left all work and pleaded with them, but we did not get any relief from the government.”

Despite paying an annual premium of ₹1,000, Dilip reports receiving no benefits from the insurance scheme.

Severe crop losses and financial strain

During the 2024 Kharif season, soybean crops in Madhya Pradesh suffer 70-90 percent losses due to excessive rainfall. The financial impact was devastating, leaving many farmers without resources to plant their next crop.

“The condition of our soybean is such that we could not even recover the harvesting costs,” report farmers from Thuna village in Sehore district.

“Now we need fertilizer and seeds for sowing wheat. We have to stand in long lines at government societies because there we get fertilizer seeds on credit and subsidy. If we had cash, we would have bought fertilizer and seeds from private shops and sowed early.”

In Chhindwara’s Chaurai region, maize crops also experienced significant damage. Bhagwat Sanodia from Surjana village told us he suffered a 75 percent loss in his maize crop. Meanwhile, Shishupal Thakur from Samaswada village notes,

“A crop insurance survey should have been conducted in the village, as the crop condition was very bad. But no officer came to inspect the crop, so there is no question of receiving insurance.”

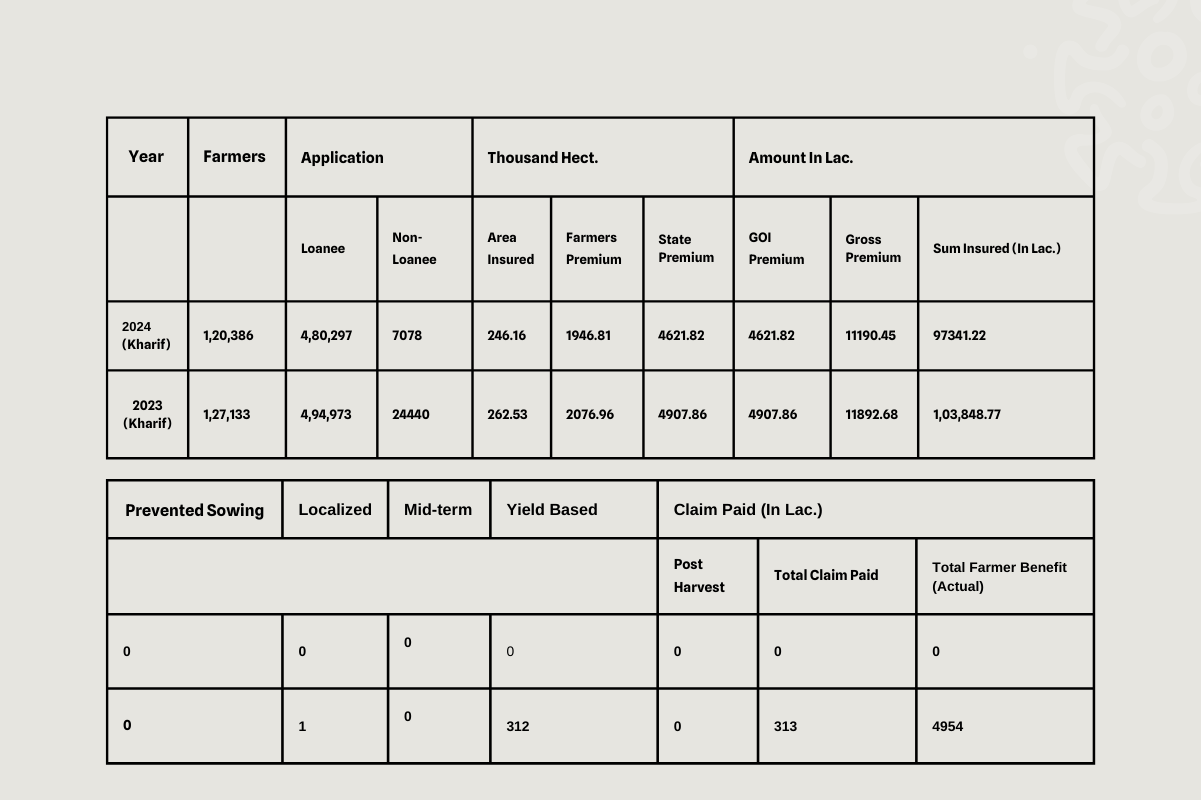

As per provisions of PMFBY guidelines, the premium share of the farmer is capped at 2% for Kharif crops, 1.5% for Rabi Crops and 5% for commercial/Horticultural crops. According to the dashboard of Pradhan Mantri Fasal Bima Yojana, in the Kharif season of 2024, the farmers of Chhindwara and Sehore districts have paid a total amount of Rs 2461.78 lakh as premium. Whereas in return, till date neither their crop has been surveyed nor the insurance amount has been received.

Information gap in claim processes

Our investigation uncovered widespread misunderstanding among farmers about how to file insurance claims. Many, like Shishupal Thakur, incorrectly believe that “crop insurance is available only when the entire area’s crop is damaged simultaneously. If only my field’s crop is damaged, then insurance is not available.”

This misconception highlights a critical information gap. Under PMFBY, claims can be filed in two ways:

- Yield-based claims: Triggered when a collector issues a notification of widespread crop failure, followed by a damage survey.

- Localized claims: Individual farmers can file these when crops are damaged specifically on their farms due to localized events.

For individual claims, farmers must notify the insurance company, bank, agriculture department, or district officials within 72 hours of crop damage. The insurance company then appoints a surveyor within 48 hours to assess losses. Based on this assessment, the company calculates the claim amount, which must be settled within 15 days of receiving the survey report.

Most farmers we spoke with were unaware of this individual claim process, instead waiting for Patwaris and Gram Sevaks to conduct village-wide surveys (Crop cutting experiments) before expecting compensation.

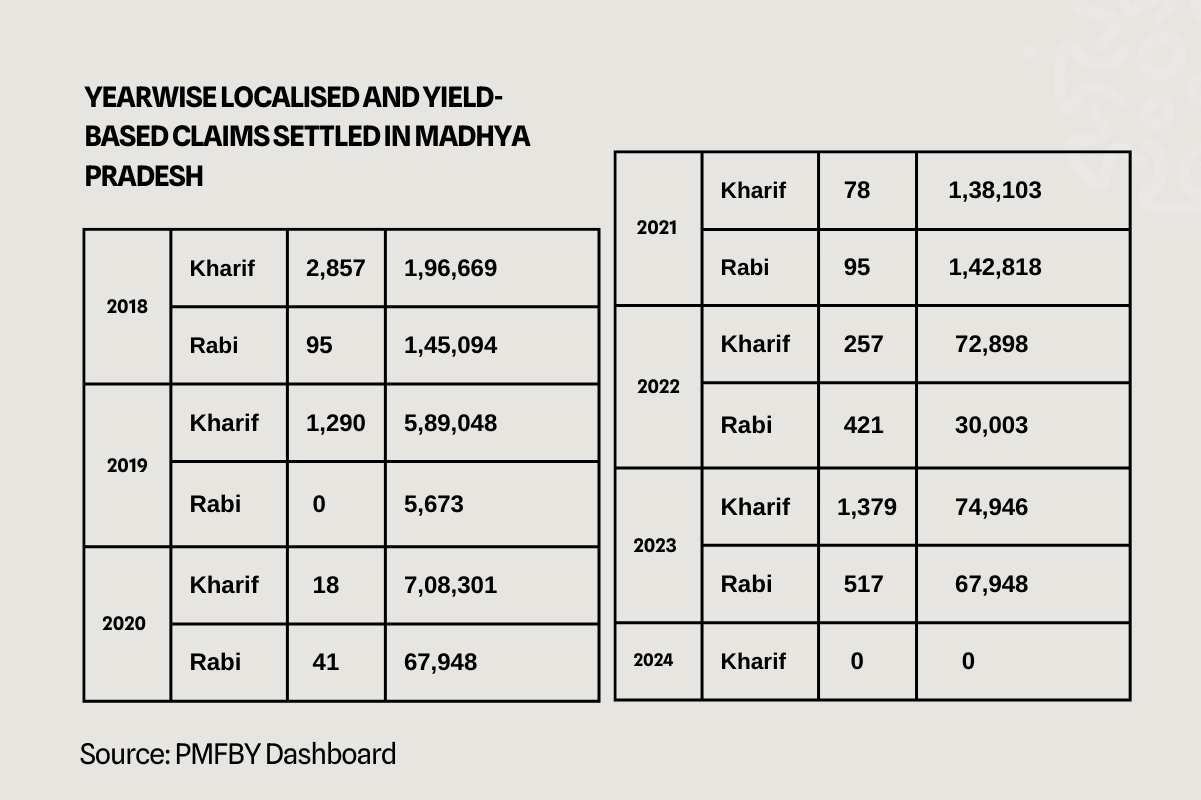

Lengthy settlement timelines

PMFBY’s dashboard data reveals that not a single claim from the Kharif 2024 season had been settled as of February 2025—more than four months after harvest time. When questioned about this delay, Sehore Agriculture Department’s Deputy Director explained,

“Yield-based claims will be given to farmers for soybean losses in the Kharif season. A survey has been conducted for this purpose. Farmers will have to wait for the insurance amount because the process for Kharif 2023 is still ongoing.”

He further suggested that farmers might need to wait a full year for Kharif 2024 compensation.

According to the Ministry of Agriculture and Farmers Welfare, a primary reason for delayed claim settlements is the tardy release of premium subsidy shares by certain states and union territories. The PMFBY operational guidelines stipulate timely release of state governments’ shares in premium subsidies, but delays by states including Assam, Bihar, Andhra Pradesh, Telangana, Madhya Pradesh, Rajasthan, West Bengal, and Gujarat have resulted in postponed claim settlements.

These delays significantly increase farmers’ financial burdens and undermine the scheme’s core purpose. Insurance is most effective when paid promptly, allowing farmers to reinvest in preparation for their next crop cycle.

Nilesh Jain from Rolagaon village last received insurance for his Rabi crop in 2021. Despite suffering losses of approximately ₹1.5 lakhs, he received just ₹15,000 in compensation. A Center for Science report on crop insurance payouts indicates that farmers bear a disproportionate share of premium costs while receiving comparatively smaller claim benefits when crops are damaged.

Technology and assessment challenges

Walking through his destroyed crop, Karan Singh points out a deceptive situation. His harvested crop appears healthy at first glance, with visible pods on the plants. However, pressing these pods reveals either no grain or severely shrunken seeds. This is the reality across his six-acre gram field, with even seed retrieval seeming unlikely.

The damage to Karan’s field requires in-person assessment by officials to accurately evaluate the extent of the loss. While PMFBY envisions using advanced technologies like satellite imagery, drones, unmanned aerial vehicles (UAVs), and remote sensing for various applications—including crop area estimation, yield disputes, and loss assessment.

As technology integration in crop damage assessment increases, questions remain about how effectively these tools can evaluate nuanced crop failures like those in Karan Singh’s field.

Despite these ongoing challenges, the Union Cabinet has granted approval for the continuation of the Pradhan Mantri Fasal Bima Yojana (PMFBY) and the Restructured Weather Based Crop Insurance Scheme (RWBCIS) until the financial year 2025-26. To support these schemes, the government has allocated a total budget of ₹69,515.71 crore. However, this allocation is the lowest in the past seven years, reflecting a significant reduction. The budget for these schemes has seen a sharp decline of nearly 23%, dropping from ₹15,864 crore in the financial year 2024-25 to ₹12,242.27 crore in 2025-26.

RWBCIS, which was introduced alongside PMFBY, follows a weather index-based methodology to assess and calculate insurance claims for farmers. This method relies on specific climatic parameters such as rainfall, temperature, and humidity to determine compensation. However, despite the differences in their approach, both PMFBY and RWBCIS continue to encounter similar implementation challenges. These hurdles include delays in claim settlements, difficulties in reaching small and marginal farmers, and administrative inefficiencies that hinder the effective execution of these insurance programs.

The road ahead

The government’s recent economic survey, released before the budget, emphasised PMFBY’s role in protecting farmers against natural calamities, pests, and diseases. While answering a question in the parliament in 2024 central government has blowed their own trumpet by calling the scheme worlds largest in terms of number of farmers insured.

Despite this fact, government data indicates a significant decline in insurance claims paid to farmers over the years. In the financial year 2018-19, farmers received ₹29,444.66 crore under various agricultural insurance schemes. However, by 2023-24, this amount had drastically reduced to ₹10,391.39 crore.

For farmers, the insurance amount is a part of the cost of their next crop. In such a situation, if the farmers do not get the money for the loss incurred in the Kharif season on time, then it puts an additional burden on the cost of the upcoming crops. Due to climate change, the incidents of crop damage are increasing, in such a situation, if the insurance amount is not paid on time, this burden on the cost is also increasing.

For India’s agricultural insurance framework to fulfill its purpose, addressing delays in claim settlements must become a priority. As climate change intensifies extreme weather events, timely compensation becomes increasingly crucial for maintaining agricultural sustainability and farmer livelihoods.

Effective implementation requires not only technological advancements but also streamlined processes, improved farmer awareness, and coordinated action between central and state governments. Until these gaps are addressed, farmers like Karan Singh and Dilip Singh will continue to view crop insurance as a promise unfulfilled, leaving them vulnerable precisely when support is most needed.

Support us to keep independent environmental journalism alive in India.

Keep Reading

Erratic rainfall: Orange farmers and traders suffer in Pandhurna

Wadda Mal’s water woes: Families fight for survival amid crisis

Chhindwara’s maize-ethanol dream: promise vs reality

Soil Health Card: Ambitious scheme faces ground-level challenges

Follow Ground Report on X, Instagram and Facebook for environmental and underreported stories from the margins. Give us feedback on our email id greport2018@gmail.com.

Don’t forget to Subscribe to our weekly newsletter, Join our community on WhatsApp, and Follow our YouTube Channel for video stories